Everything You Required to Learn About Creating a Customized Debt Monitoring Strategy

In the realm of individual financing, devising a customized financial obligation management strategy is often the cornerstone of attaining monetary security and comfort. By carefully reviewing your present economic commitments, establishing attainable monetary purposes, and crafting a useful budget plan, you lead the way for efficient debt settlement techniques. Nevertheless, the trip to financial liberty is not solely about first planning; it also calls for ongoing monitoring and modifications to make certain ongoing progress. As you browse the intricacies of developing a customized financial obligation management plan, recognizing the ins and outs of each action is vital to your monetary success.

Evaluating Your Existing Financial Debt Scenario

One should initially conduct a detailed evaluation of their existing debt commitments prior to creating an efficient financial obligation management plan. Create a detailed checklist of each financial obligation, including the total quantity owed, interest rates, minimum monthly settlements, and due dates.

After compiling this details, determine your total debt-to-income ratio by dividing your month-to-month financial obligation payments by your month-to-month earnings. This ratio is a vital sign of your capability to handle present financial debt levels properly. In addition, evaluate your credit score report to identify any mistakes or discrepancies that might be impacting your credit scores score. Comprehending these aspects of your monetary situation will certainly guide you in creating a customized financial obligation monitoring plan customized to your particular needs and objectives.

Setting Financial Goals and Targets

When setting financial goals, it's important to be specific, quantifiable, achievable, relevant, and time-bound (WISE) For instance, you could set an objective to pay off a specific quantity of financial debt within a details timespan, such as minimizing your charge card balance by $5,000 in the next 12 months - More Discussion Posted Here. By setting clear targets similar to this, you can track your progress and remain inspired to accomplish your financial obligation management purposes

Additionally, take into consideration prioritizing your financial debts based on aspects such as rate of interest prices, impressive equilibriums, and settlement terms. By focusing on high-interest financial debts first, you can save money in the future and accelerate your journey towards monetary liberty. Bear in mind, everyone's financial circumstance is unique, so customize your goals and targets to fit your specific needs and conditions.

Creating a Realistic Budget Plan

Crafting a well-defined spending plan is a basic action in reliable financial obligation monitoring and economic planning. A sensible spending plan works as a roadmap for your monetary health, assisting you track your earnings, costs, and financial debt repayments. To develop a useful budget plan, beginning by providing all your income sources. This includes your income, side hustle incomes, or any type of various other monetary inflows. Next off, brochure all your taken care of expenditures such as lease or mortgage, utilities, insurance coverage, and car loan repayments. Variable expenditures like grocery stores, amusement, and transportation should also be included. Differentiate between requirements and desires to prioritize important expenses and identify areas where you can reduce.

When establishing budget plan limitations, be truthful with on your own regarding your costs routines and financial commitments. Designate a portion of your income in the direction of settling debt while ensuring you have some funds for emergency situations and savings. Routinely evaluation and change your spending plan as needed to remain on track with your financial goals and debt settlement plan. By sticking to a reasonable budget, you can properly manage useful reference your financial debt and work in the direction of a much more secure monetary future.

Checking Out Financial Debt Repayment Techniques

After developing a sensible budget plan, the following essential action in efficient financial obligation monitoring is to explore different financial debt payment methods. One common technique is the snowball approach, where you focus on paying off the smallest financial debts initially while making minimal payments on bigger debts. This method can assist develop energy as you see smaller sized financial debts being gotten rid of, supplying motivation to tackle larger ones.

Another approach is the avalanche method, which involves focusing on debts with the highest rate of interest rates. By targeting high-interest financial obligations first, you can decrease the total quantity you pay in rate of interest in time. This technique might be a lot more cost-efficient in the future, also though it could take longer to see individual debts completely repaid.

Debt debt consolidation is one more choice where you incorporate numerous financial debts right into a solitary financing with a reduced rates of interest. This can simplify your settlement process and potentially lower the overall passion paid. However, it's important to very carefully consider the terms and fees connected with loan consolidation to guarantee it's the ideal choice for your economic circumstance.

Monitoring and Adjusting Your Strategy

Changing your plan might involve reapportioning funds to tackle high-interest debts first, discussing with financial institutions for reduced rate of interest or better payment terms, or checking out extra income resources to accelerate financial debt payment. As your economic situation develops, your financial debt monitoring plan should adjust as necessary to continue to be effective. By staying flexible and aggressive in surveillance and readjusting your strategy, you can optimize your efforts towards paying off your financial debts efficiently and achieving your economic objectives.

Verdict

Finally, producing an individualized debt monitoring strategy includes evaluating current debt, setting financial objectives, producing a reasonable spending plan, exploring settlement methods, and tracking and readjusting the plan as needed. By adhering to these actions, individuals can take control of their economic scenario and work in the direction of ending up being debt-free. It is necessary to stay regimented and committed to the strategy in order to accomplish long-lasting monetary stability.

One should initially carry out a thorough analysis of their existing financial obligation obligations before developing an efficient debt administration strategy.After establishing a practical budget plan, the following important action in effective financial debt management is to check out numerous financial obligation settlement strategies - More Discussion Posted Here.To successfully handle your debt, continual tracking and change of your debt monitoring strategy are important parts for long-term monetary stability.Changing your strategy might entail reallocating funds to take on high-interest debts first, discussing with financial institutions for lower passion prices or better repayment terms, or exploring added income sources to speed up financial obligation repayment.In final thought, developing a personalized financial debt administration plan involves evaluating existing financial debt, setting economic goals, creating a practical spending plan, checking out repayment techniques, and monitoring and adjusting the plan as required

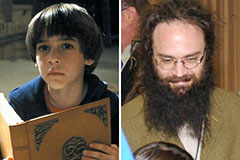

Barret Oliver Then & Now!

Barret Oliver Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Kane Then & Now!

Kane Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!